- Record: found

- Abstract: found

- Article: found

Extending health insurance to the poor in India: An impact evaluation of Rashtriya Swasthya Bima Yojana on out of pocket spending for healthcare

Read this article at

Abstract

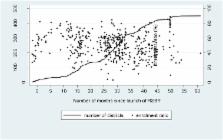

India launched the ‘Rashtriya Swasthya Bima Yojana’ (RSBY) health insurance scheme for the poor in 2008. Utilising 3 waves (1999–2000, 2004–05 and 2011–12) of household level data from nationally representative surveys of the National Sample Survey Organisation (NSSO) (N = 346,615) and district level RSBY administrative data on enrolment, we estimated causal effects of RSBY on out-of-pocket expenditure. Using ‘difference-in-differences’ methods on households in matched districts we find that RSBY did not affect the likelihood of inpatient out-of-pocket spending, the level of inpatient out of pocket spending or catastrophic inpatient spending. We also do not find any statistically significant effect of RSBY on the level of outpatient out-of-pocket expenditure and the probability of incurring outpatient expenditure. In contrast, the likelihood of incurring any out of pocket spending (inpatient and outpatient) rose by 30% due to RSBY and was statistically significant. Although out of pocket spending levels did not change, RSBY raised household non-medical spending by 5%. Overall, the results suggest that RSBY has been ineffective in reducing the burden of out-of-pocket spending on poor households.

Highlights

-

•

RSBY has no effects in reducing probability of incurring and level of inpatient expenditure.

-

•

Probability of catastrophic inpatient expenditure declined only marginally.

-

•

Probability of incurring of total out-of-pocket expenditure increased by 30%.

-

•

Non-medical expenditure of households increased by 6% after the RSBY intervention.

Related collections

Most cited references28

- Record: found

- Abstract: found

- Article: not found

Extending health insurance to the rural population: an impact evaluation of China's new cooperative medical scheme.

- Record: found

- Abstract: found

- Article: not found

Health insurance and the demand for medical care: evidence from a randomized experiment.

- Record: found

- Abstract: found

- Article: not found